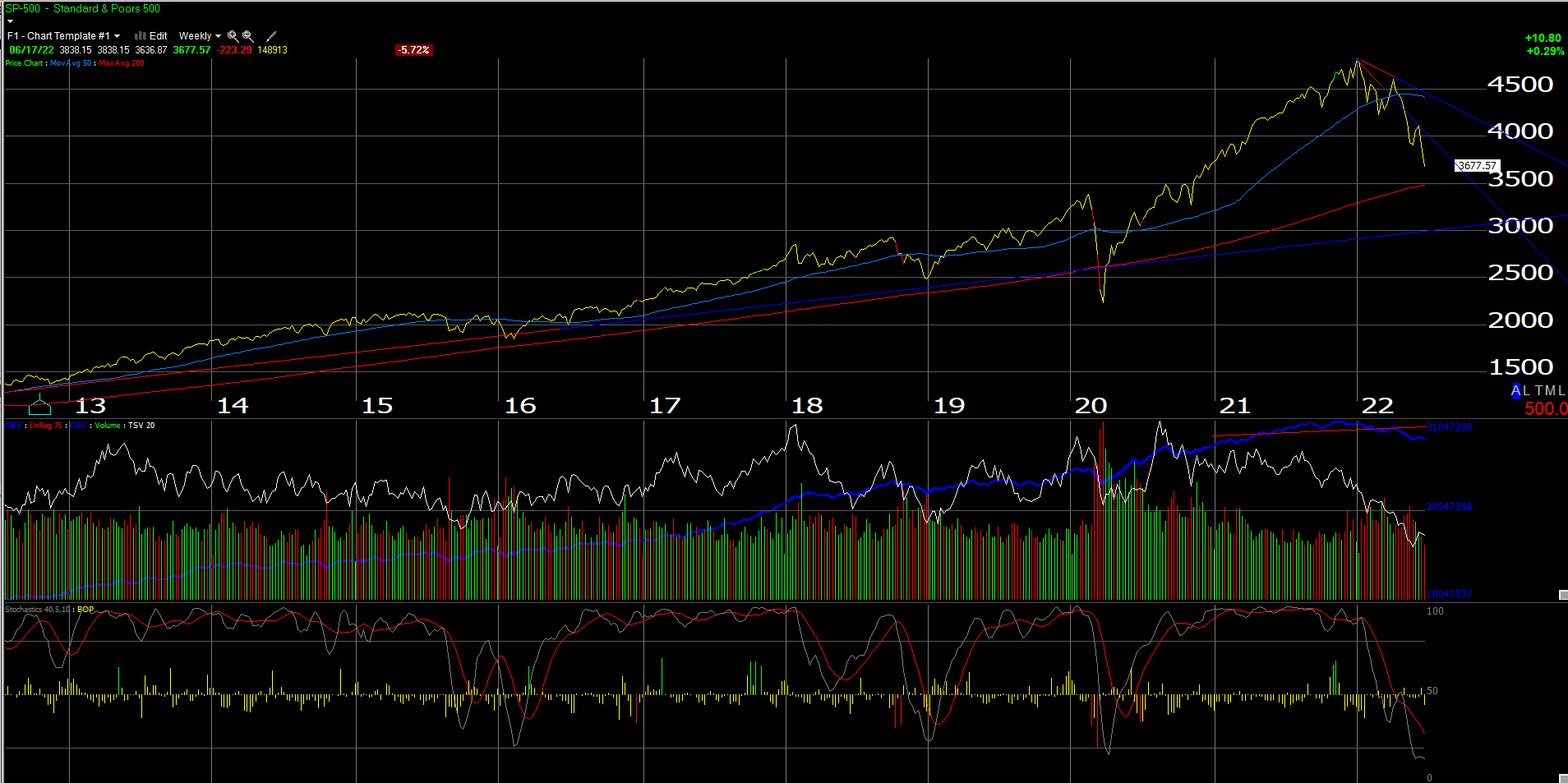

Sp 500 Chart Remains Negative Despite Oversold Conditions

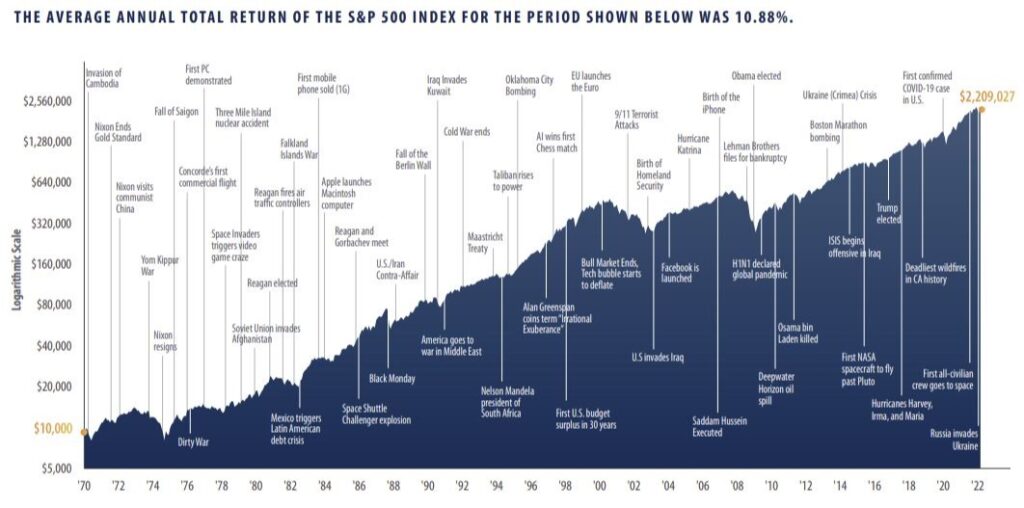

Sp 500 Chart Remains Negative Despite Oversold Conditions - Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web jul 19, 2024, 8:23 am pdt. Therefore gains are likely to be limited with. I see no indication that gold will recover at this stage. Total returns include two components: Web the stock market, as measured by the s&p 500 index spx, bounced off the lower trend line of the bear market last week. Web i think the outlook remains negative despite oversold conditions. Volatility measures, on the other hand, have. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web interactive chart for s&p 500 (^gspc), analyze all the data with a huge range of indicators. Web again, this is a negative indicator that is in an oversold condition. Web the s&p 500 index stretched its oversold rally about as far as it could. Web daily chart of s&p 500 index. Volatility measures, on the other hand, have. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Therefore gains are likely to be limited with. The ensuing rally has been strong, fueled. Web most recently, the mcclellan oscillator became overbought on march 31st and april 3rd, but the ppo remains above its signal line. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web i think the outlook remains negative despite oversold conditions. Web the s&p 500's valuation is subjective and could rise instead of falling, with increasing growth opportunities and a more accessible monetary environment. The return generated by dividends. Web the s&p. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the. Web jul 19, 2024, 8:23 am pdt. Stock market, as measured by the s&p 500 index spx, has continued to fall, even as oversold conditions abound and. Volatility measures, on the other. The return generated by dividends. This rally began in late october, initially spurred by a deeply. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web in summary, the negative picture that was developing in the past couple of weeks is still in place, despite the strong oversold rally earlier. However, these oversold conditions produce buy signals that can be traded. The return generated by dividends. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. Web i think the outlook remains negative despite oversold conditions. Web the s&p 500 chart has a negative pattern now, after having broken down below previous. Web 'oversold does not mean buy.' the u.s. Web the stock market, as measured by the s&p 500 index spx, has decisively broken out to the upside. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. Web again, this is a negative indicator that is in an oversold condition. Web s&p 500. Therefore gains are likely to be limited with. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web the s&p 500 index stretched its oversold rally about as far as it could. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal.. Web 'oversold does not mean buy.' the u.s. The total returns of the s&p 500 index are listed by year. Web based partly on the downtrend of the spx chart, we are maintaining a “core” bearish position. The s&p 500 index has stalled out at its july high around 4600, and overbought readings from rsi indicate a likely pullback. This. Web the s&p 500 chart is extremely bearish right now. Web in summary, the negative picture that was developing in the past couple of weeks is still in place, despite the strong oversold rally earlier this week. Volatility measures, on the other hand, have. Web s&p 500 total returns by year since 1926. Web based partly on the downtrend of. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the. Volatility measures, on the other hand, have. Web daily chart of s&p 500 index. Web again, this is a negative indicator that is in an oversold condition. Web the s&p 500 chart. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. I see no indication that gold will recover at this stage. Web the s&p 500 index stretched its oversold rally about as far as it could. Web jul 19, 2024, 8:23 am pdt. Web the s&p 500 chart has a negative pattern. Web s&p 500 total returns by year since 1926. Web the s&p 500 index stretched its oversold rally about as far as it could. Therefore gains are likely to be limited with. Web the s&p 500's valuation is subjective and could rise instead of falling, with increasing growth opportunities and a more accessible monetary environment. Web the s&p 500 chart has a negative pattern now, after having broken down below previous support at 5,050. Web interactive chart of the s&p 500 stock market index since 1927. However, these oversold conditions produce buy signals that can be traded. Web the above indicators are what we call “market internals,” and they have been fairly negative in line with the decline in spx. Web i think the outlook remains negative despite oversold conditions. Web again, this is a negative indicator that is in an oversold condition. This rally began in late october, initially spurred by a deeply. Web the stock market, as measured by the s&p 500 index spx, bounced off the lower trend line of the bear market last week. This means the s&p 500 is. Web 'oversold does not mean buy.' the u.s. Web the s&p 500 would have to fall to 5,228 in order to trigger that mvb sell signal. Web cumulative breadth indicators continue to lag behind the market, so the negative divergence that has been in place since early june is still a drag on the.S P 500 10 Years Charts Of Performance vrogue.co

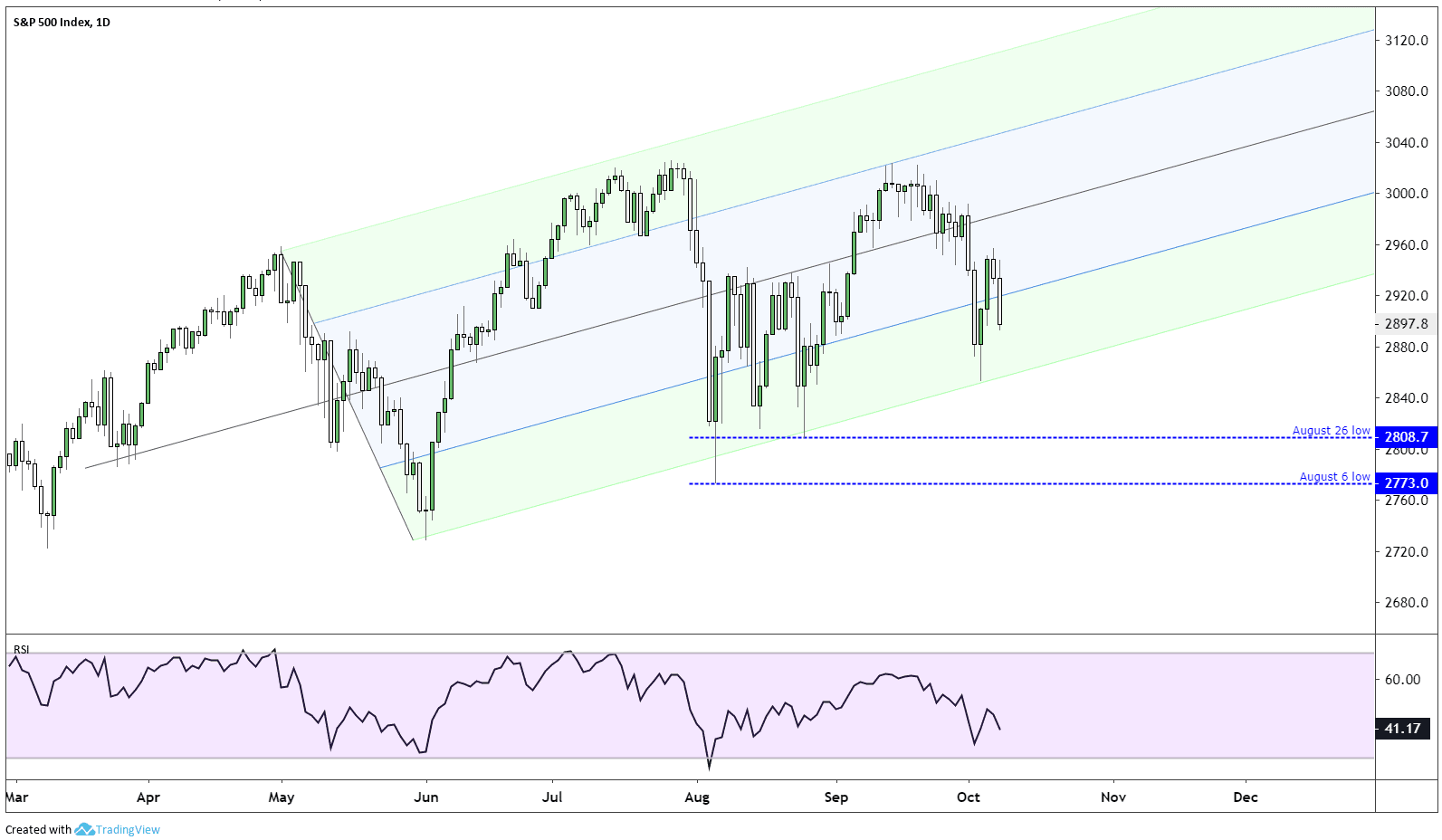

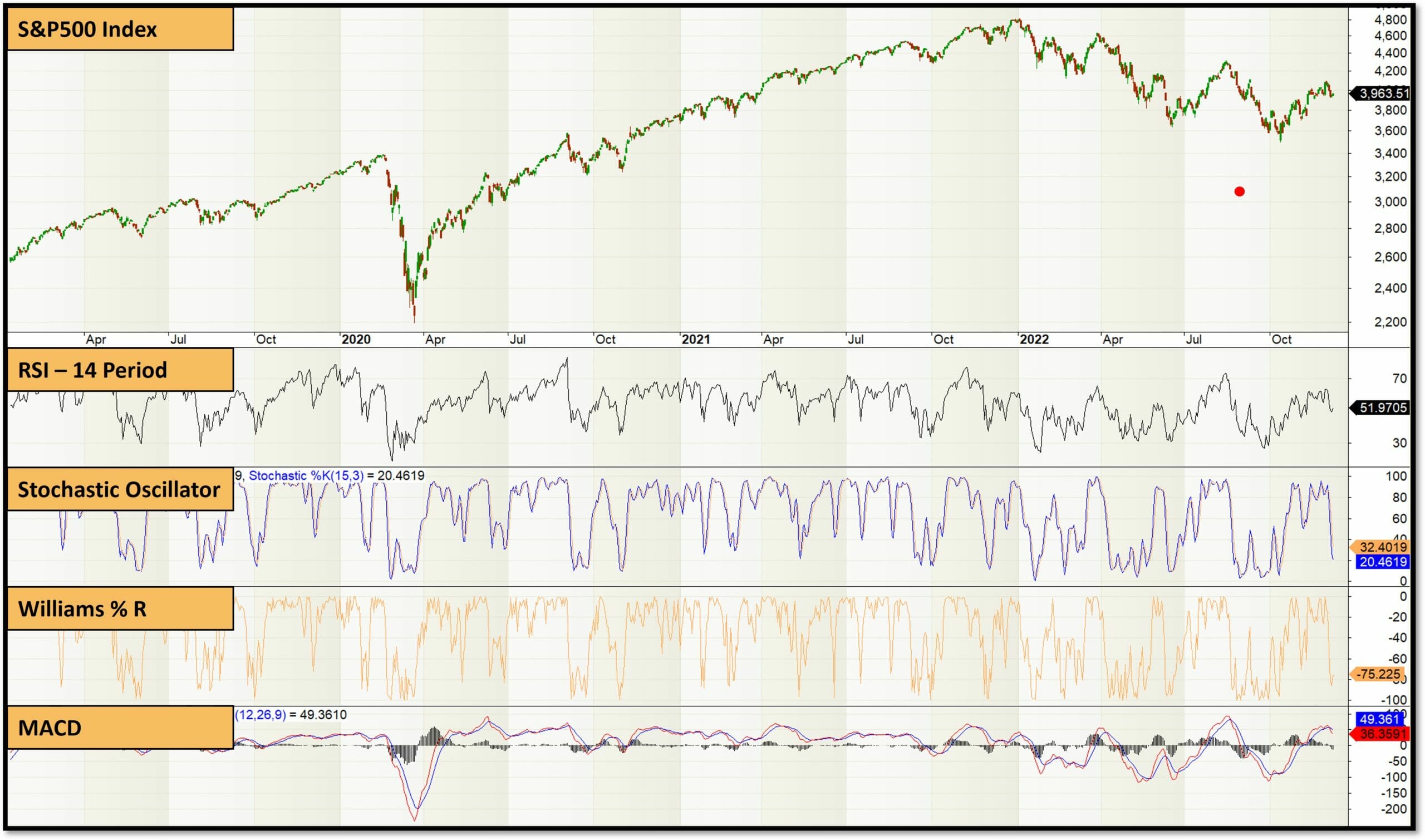

Oversold Bounces on S&P 500 and NASDAQ, Volatility Remains Unchanged

S And P 500 Chart

Fear and Greed Index Nears Oversold Levels, S&P 500, Dow Jones

SP 500 Chart Poplar Forest Funds

Mastering the Relative Strength Index (RSI) A Trader’s Guide

Growth of S&P 500 Thru Crisis and Events from 1970 to 2022 Chart

Equities Remain In An Extreme Oversold Condition Seeking Alpha

S P 500 Printable Chart Free Printable Download

S&P 500 Seems Dramatically Oversold, P/E Now At 15.5x And Earnings

Volatility Measures, On The Other Hand, Have.

Web Most Recently, The Mcclellan Oscillator Became Overbought On March 31St And April 3Rd, But The Ppo Remains Above Its Signal Line.

A Downside Breakout Below Current Support At 5,260 Could Easily Reach 5,228,.

Total Returns Include Two Components:

Related Post: