Present Value Chart 1

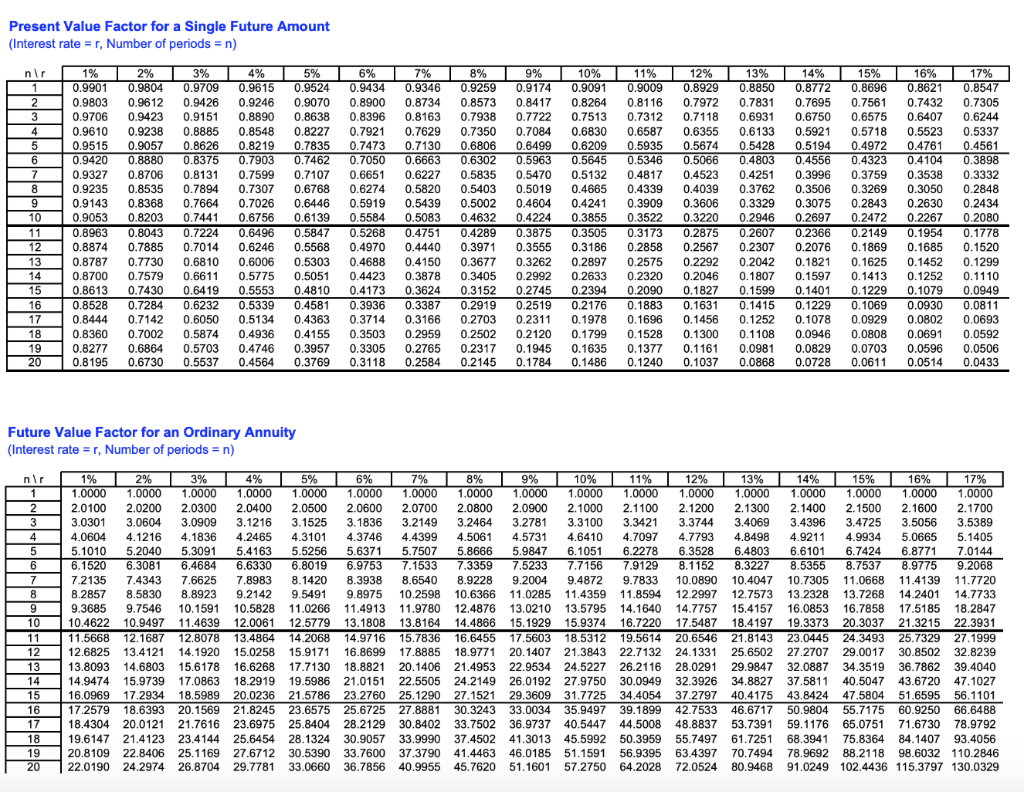

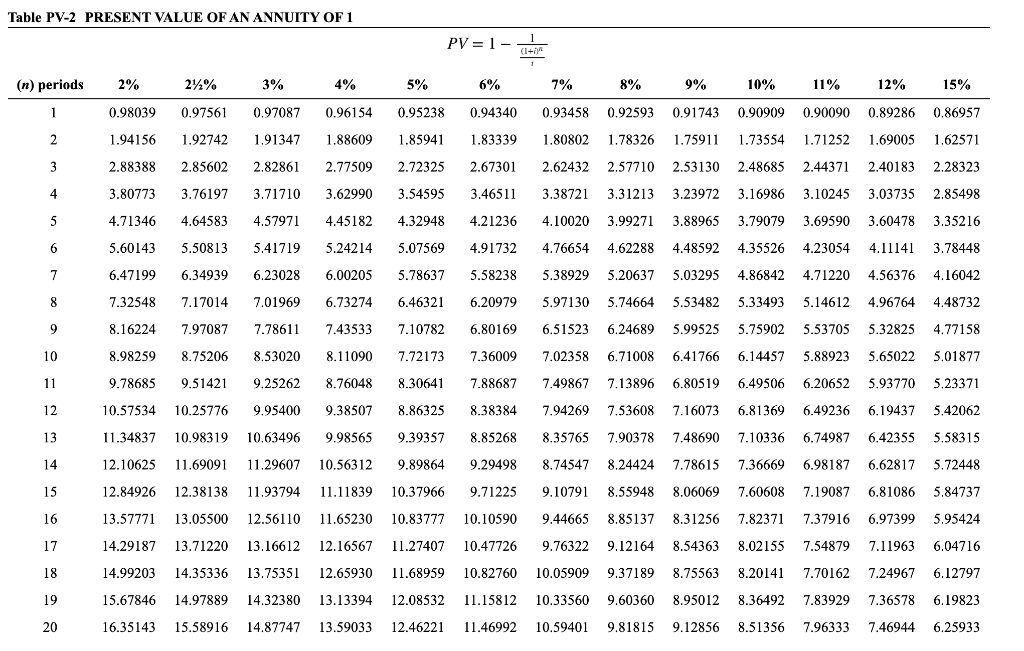

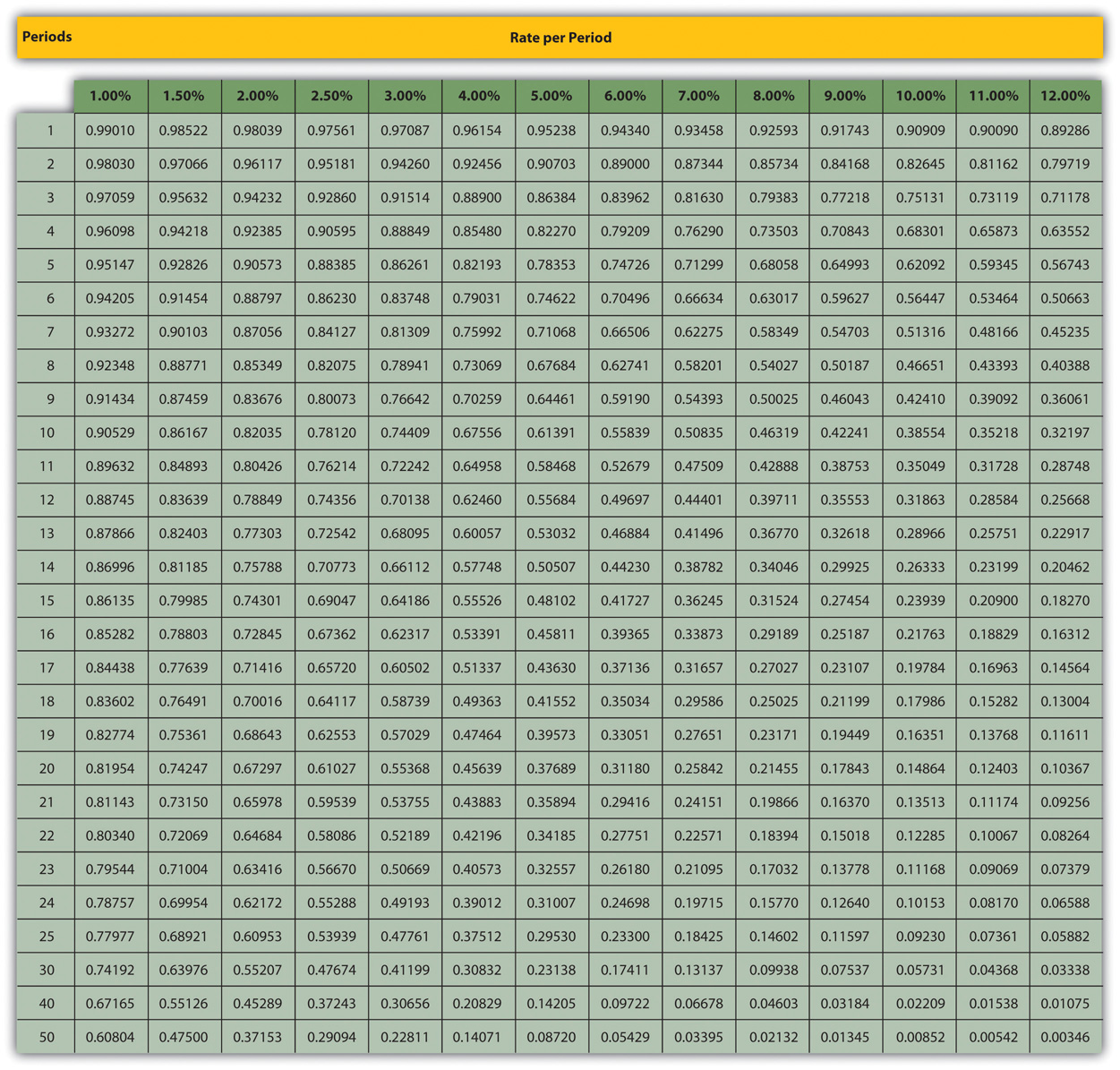

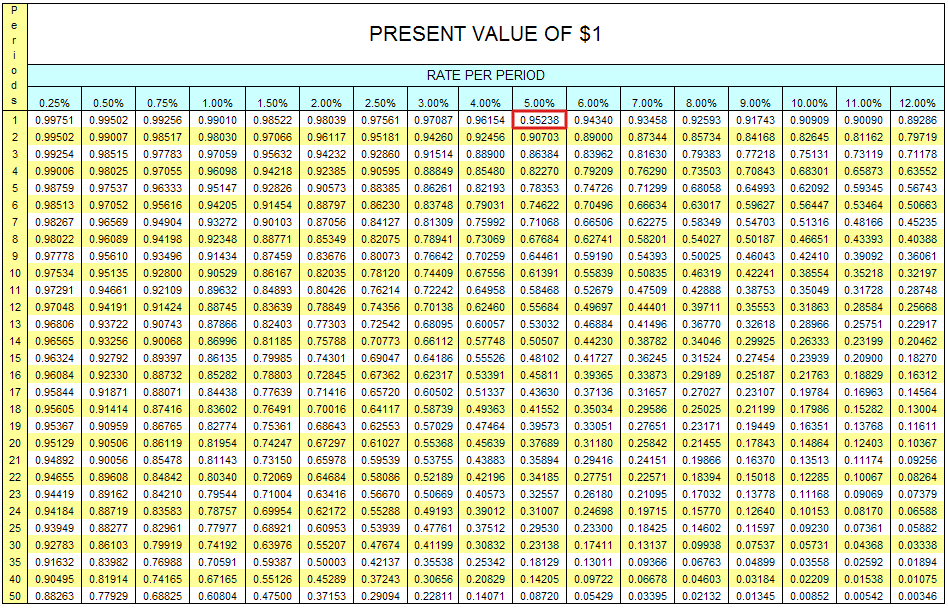

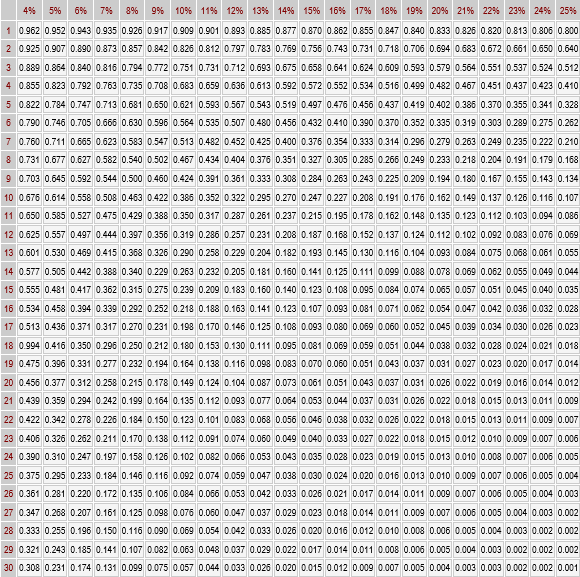

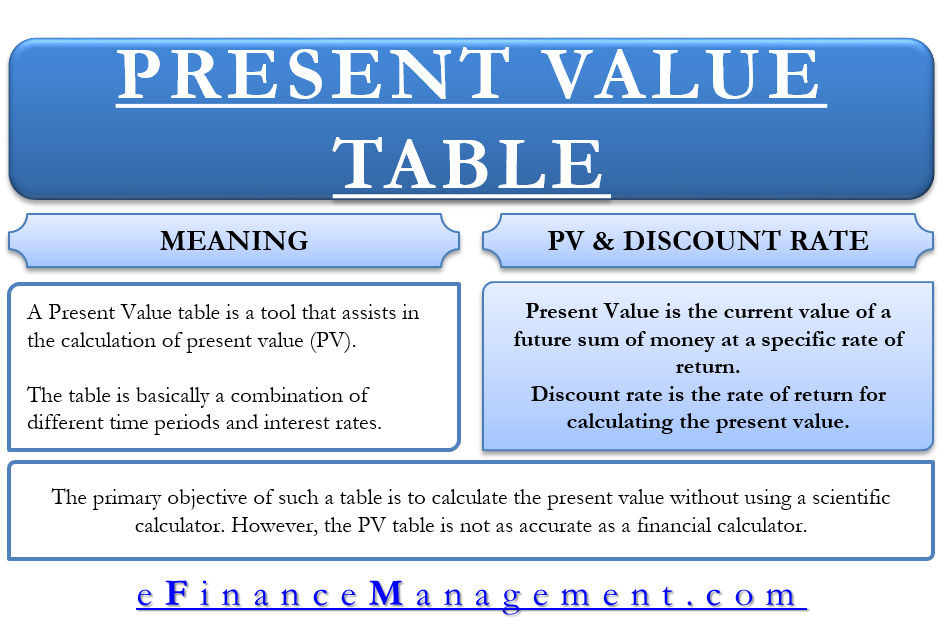

Present Value Chart 1 - Here’s what each symbol means: Getting money now or later. C1 = cash flow from 1 period; Web present value (pv) is the current value of a future sum of money or stream of cash flows. Web learn what present value (pv) and future value (fv) are and how to calculate present value in excel given the future value, interest rate, and period. $100 / (1 + 0.08) 2 = $85.73. Web what is the definition of present value table? It is used to calculate the present value of any single amount. Web calculate the present value of a future sum, annuity or perpetuity with compounding, periodic payment frequency, growth rate. So, the table provides present value coefficients for a given discount rate and time. It is determined by discounting the future value by the estimated rate of return that the money could. A pv table lists different discount rates in the first column and different time periods in the first row. Present value is calculated from the formula. Web learn what present value (pv) and future value (fv) are and how to calculate present value in excel given the future value, interest rate, and period. Web the present value formula is calculated by dividing the cash flow of one period by one plus the rate of return to the nth power. Present value helps compare money received today to money received in the future. Web how many refugees are there around the world? Getting money now or later. Web what is the definition of present value table? Web divide the future value by (1 + rate of interest) n. The easiest and most accurate way to calculate the present value of any future amounts (single amount, varying amounts, annuities) is to use an electronic financial calculator or computer software. It is used to calculate the present value of any single amount. Web the present value (pv) calculates how much a future cash flow is worth today, whereas the future. Table 1 future value of $1 fv = $1 (1 + i ) n n / i Web this table shows the present value of $1 at various interest rates (i) and time periods (n). This value will differ from the cash flows’ nominal value, since time itself affects value. This helps decide which option is better: Web the present. At least 117.3 million people around the world have been forced to flee their homes. Web a present value table or a pv table lists different periods in the first row and different discount rates in the first column. Among them are nearly 43.4 million refugees, around 40 per cent of whom are under the age of 18. Web present. Web calculate the present value of a future sum, annuity or perpetuity with compounding, periodic payment frequency, growth rate. In the table, the time can be in weeks, months, or years. The present value of a future value investment amount. A discount rate selected from this table is then multiplied by a cash sum to be received at a future. To find present value, we discount future money using a discount rate (like 5%). It sounds confusing, but it’s quite simple. Web free financial calculator to find the present value of a future amount or a stream of annuity payments. So, the table provides present value coefficients for a given discount rate and time. Web this table shows the present. In the table, the time can be in weeks, months, or years. Web the present value (pv) calculates how much a future cash flow is worth today, whereas the future value is how much a current cash flow will be worth on a future date based on a growth rate assumption. It is used to calculate the present value of. Present value formulas, tables and calculators. A discount rate selected from this table is then multiplied by a cash sum to be received at a future date, to arrive at its present value. So, the table provides present value coefficients for a given discount rate and time. Web present value of 1 used in recording a transaction. Web the present. To find present value, we discount future money using a discount rate (like 5%). Present value formula pv=fv/ (1+i)ⁿ. The easiest and most accurate way to calculate the present value of any future amounts (single amount, varying amounts, annuities) is to use an electronic financial calculator or computer software. So, the table provides present value coefficients for a given discount. Present value formula pv=fv/ (1+i)ⁿ. It sounds confusing, but it’s quite simple. Web a present value table or a pv table lists different periods in the first row and different discount rates in the first column. Web figure 17.3 present value of ordinary annuity (annuity in arrears—end of period payments) Web this table shows the present value of $1 at. $100 / (1 + 0.08) 2 = $85.73. Web present value (pv) is the current value of a future sum of money or stream of cash flows. Web what is the definition of present value table? Web calculate the present value of a future sum, annuity or perpetuity with compounding, periodic payment frequency, growth rate. To find present value, we. Here’s what each symbol means: Web what is a present value of 1 table? Web divide the future value by (1 + rate of interest) n. Web a present value table or a pv table lists different periods in the first row and different discount rates in the first column. Web how many refugees are there around the world? The present value of a future value investment amount. Now you know how to estimate the present value of your future income on your own, or you can simply use our present value calculator. Present value formulas, tables and calculators. Web present value tables present value of one dollar period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 Web the present value (pv) calculates how much a future cash flow is worth today, whereas the future value is how much a current cash flow will be worth on a future date based on a growth rate assumption. Present value is calculated from the formula. In our example, it will look like this: Web figure 17.3 present value of ordinary annuity (annuity in arrears—end of period payments) This helps decide which option is better: Web present value tables are used to calculate the present value of future amounts using the formula pv=fv/(1+i)^n. Web calculate the present value of a future sum, annuity or perpetuity with compounding, periodic payment frequency, growth rate.How to use PVIF or Present value Interest Factor table YouTube

Present Value Of Ordinary Annuity Table 14 Awesome Home

Present Value Tables Double Entry Bookkeeping

Solved Table PV1 PRESENT VALUE OF 1 (n) periods 2 2/ 3

Present Value Table.pdf Present Value Mathematical Finance

Solved TABLE 1 Present Value of 1 Periods 4 6 7 8 10

Appendix Present Value Tables

What is a Present Value Table? Definition Meaning Example

Present value of 1 table Accounting for Management

Present Value Table Meaning, Important, How To Use It

Present Value Helps Compare Money Received Today To Money Received In The Future.

Table 1 Future Value Of $1 Fv = $1 (1 + I ) N N / I

This Value Will Differ From The Cash Flows’ Nominal Value, Since Time Itself Affects Value.

Web The Present Value Formula Is Calculated By Dividing The Cash Flow Of One Period By One Plus The Rate Of Return To The Nth Power.

Related Post: