Glide Path Chart

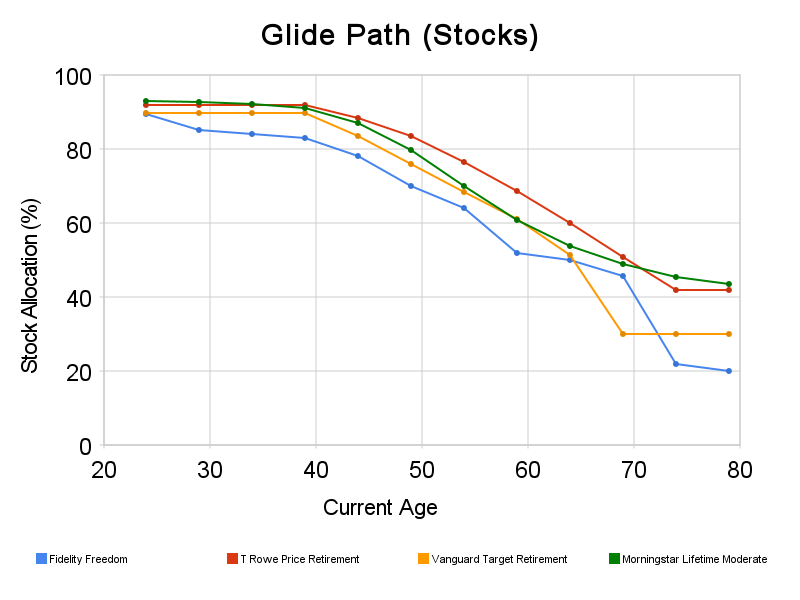

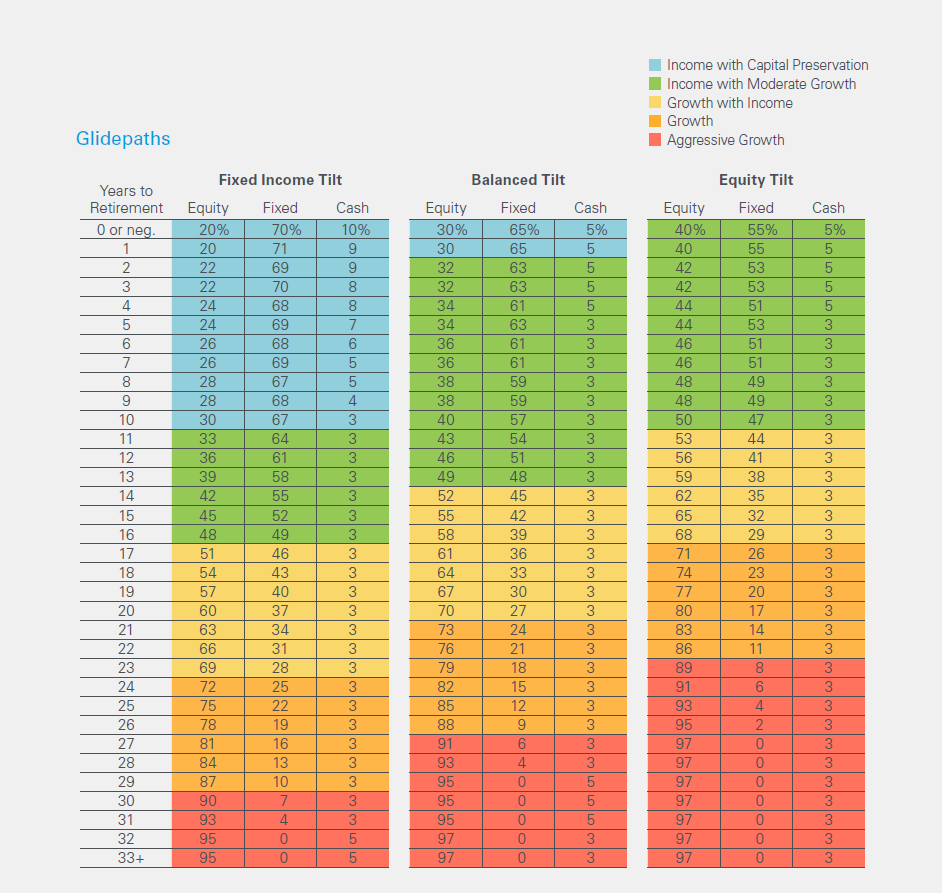

Glide Path Chart - Web this is commonly known as a glide path. The glide path essentially shows how a. Web a glide path is the change in a target date fund’s asset mix as time goes by. Discovering more about glide path formulas can help you formulate your retirement blueprint. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. This is the key behind a target retirement fund. I then calculate the median and the 25th and 75th percentile equity level across each age. When improving our kpi, each change in the planned performance should align with the expected completion of an. Web a glide path is simply the way the asset mix within a target date fund changes over time. Web there are two types of glide paths: Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. Our changing emerging markets equity exposure is an example of this. Web the glide path formula is a method for calculating how the asset allocation of an investment portfolio should change over time. There are three main types of glide paths: It appears there is a general. (1) static glide path, (2) declining glide path, and (3). Typically, the mix gets more conservative — with fewer stocks and. Web a target retirement fund will—automatically—rebalance over time via its glide path. Web in investing terms, a “glide path” describes how a mix of investments changes over time. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. The glide path essentially shows how a. You can buy individual funds and watch your spread over. (1) static glide path, (2) declining glide path, and (3). This is the key behind a target retirement fund. View the sample bubble chart to tell if your retirement plan is right for participants. Typically, the mix gets more conservative — with fewer stocks and. Web a target retirement fund will—automatically—rebalance over time via its glide path. I then calculate the median and the 25th and 75th percentile equity level across each age. Web in investing terms, a “glide. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. Target retirement fund and trust. There are three main types of glide paths: As investors navigate the terrain of. Web in investing terms, a “glide path” describes how a mix of investments changes over time. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. Web a glide path is the change in a target date fund’s asset mix as time goes by. The glide path essentially shows how a. Web based on data obtained from morningstar inc., chart 1 illustrates the variation among target date. Web this simulation exercise gives us 1000 independent optimal glide paths. You can buy individual funds and watch your spread over. Web a glide path is the change in a target date fund’s asset mix as time goes by. Web in investing terms, a “glide path” describes how a mix of investments changes over time. Web the three types of. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Web if you've been looking to add a new and visually appealing element to your data visualization game in excel, look no further than the glide path chart. It appears there is a general. As investors navigate the terrain of. Web in investing. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Its purpose is to optimize returns and manage. Web this shift in asset allocation is the glide path. Web this simulation exercise gives us 1000 independent optimal glide paths. The glide path essentially shows how a. There are three main types of glide paths: Discovering more about glide path formulas can help you formulate your retirement blueprint. Typically, the mix gets more conservative — with fewer stocks and. (1) static glide path, (2) declining glide path, and (3). This is the key behind a target retirement fund. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go. The glide path essentially shows how a. Web in investing terms, a “glide path” describes how a mix of investments changes over time. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths. Web a target retirement fund will—automatically—rebalance over time via its glide path. Web a glide path is simply the way the asset mix within a target date fund changes over time. Web an equity glide path refers to the changes to the equity portion of your asset allocation over time. Web this is commonly known as a glide path. Web. View the sample bubble chart to tell if your retirement plan is right for participants. Web the glide path formula is a method for calculating how the asset allocation of an investment portfolio should change over time. There are three main types of glide paths: Web a glide path is the change in a target date fund’s asset mix as time goes by. Web a glide path is simply the way the asset mix within a target date fund changes over time. Discovering more about glide path formulas can help you formulate your retirement blueprint. Web based on data obtained from morningstar inc., chart 1 illustrates the variation among target date providers’ glide paths. Our changing emerging markets equity exposure is an example of this. Allocation between own, loan and reserve super classes will determine the bulk of your investment returns. Web a target retirement fund will—automatically—rebalance over time via its glide path. The formula typically uses the. Web the three types of glide paths are linear, step, and custom. (1) static glide path, (2) declining glide path, and (3). Target retirement fund and trust. Linear glide paths involve a gradual shift in asset allocation over time, step glide paths involve a. Those that go to the target date, when the fund typically keeps the same asset mix throughout retirement, and those that go.Glide Path A TargetDate Fund's Secret Sauce

Glide Path Chart A Visual Reference of Charts Chart Master

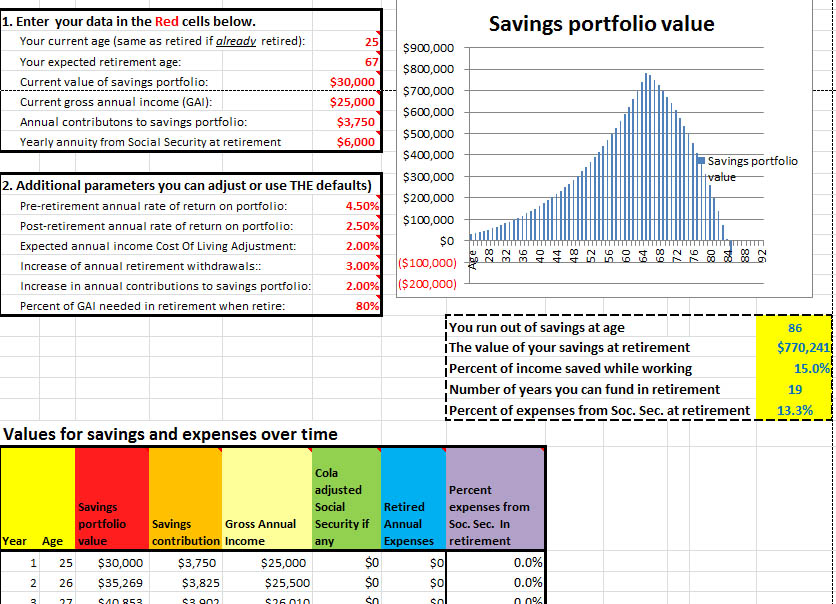

Glide Path Template Excel

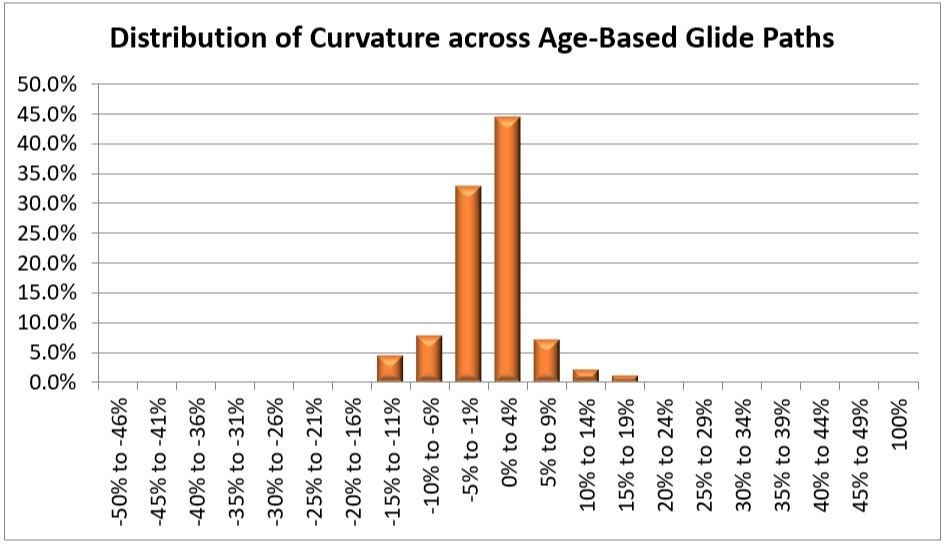

How to Evaluate the Risk of Investment Glide Paths

The New Rules of Growth vs. Profitability

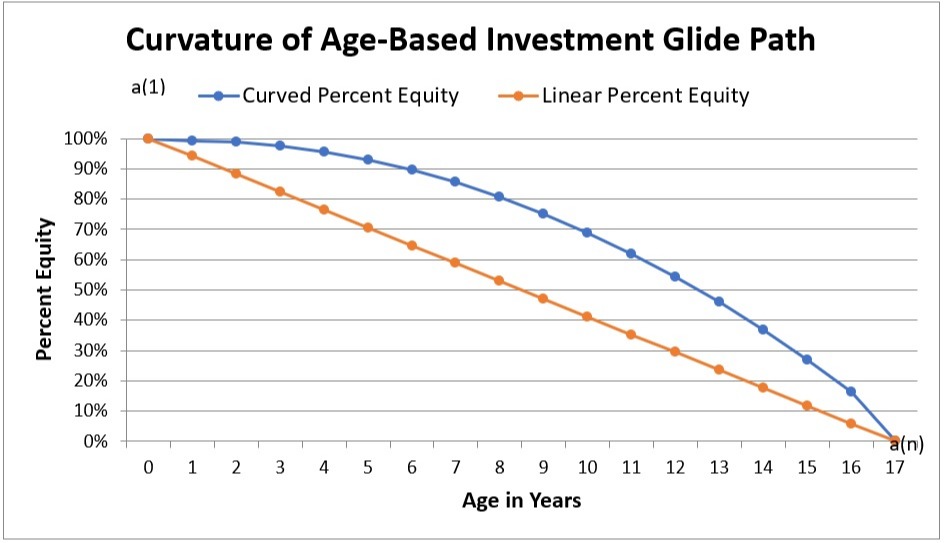

How to Design a Glide Path (Part 1) by Spencer Look Medium

What Is A Glide Path Chart A Visual Reference of Charts Chart Master

Understanding TDF Glide Paths PLANSPONSOR

Glide Path Template

Glide Paths Within the Glide Path PLANADVISER

I Then Calculate The Median And The 25Th And 75Th Percentile Equity Level Across Each Age.

Web This Is Commonly Known As A Glide Path.

Web In The Investment World, The Term Glide Path Refers To The Process By Which A Target Date Fund Changes Its Asset Allocation Among Risky Assets (Which Can Include.

Web In Investing Terms, A “Glide Path” Describes How A Mix Of Investments Changes Over Time.

Related Post: