Cup With Handle Pattern Chart

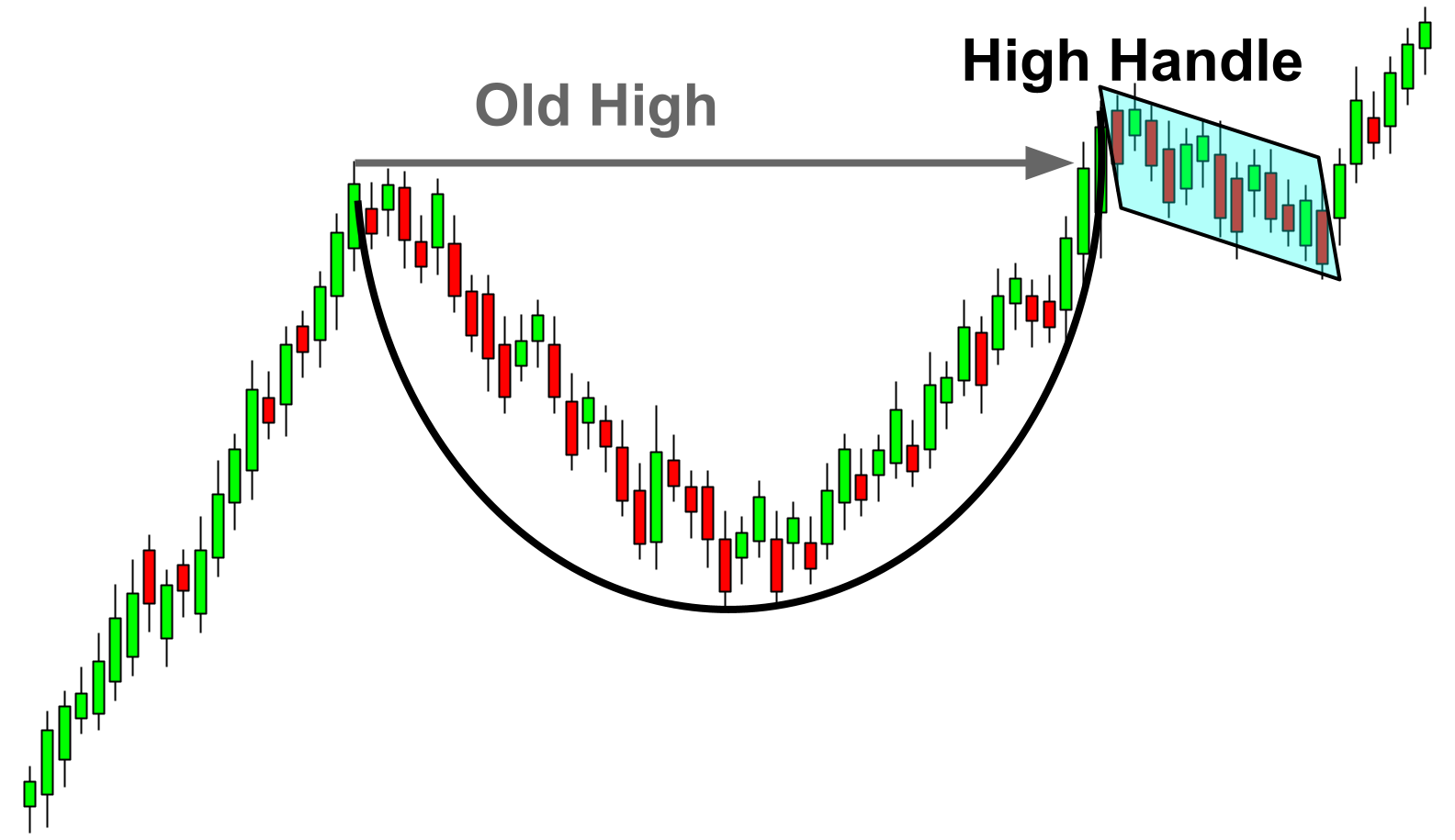

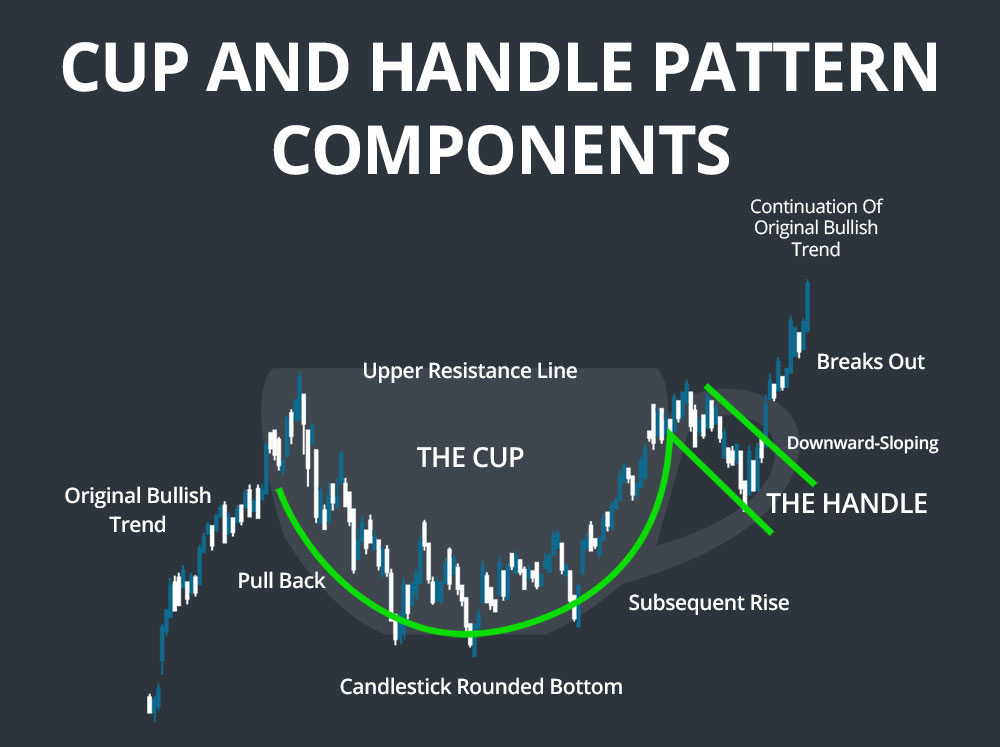

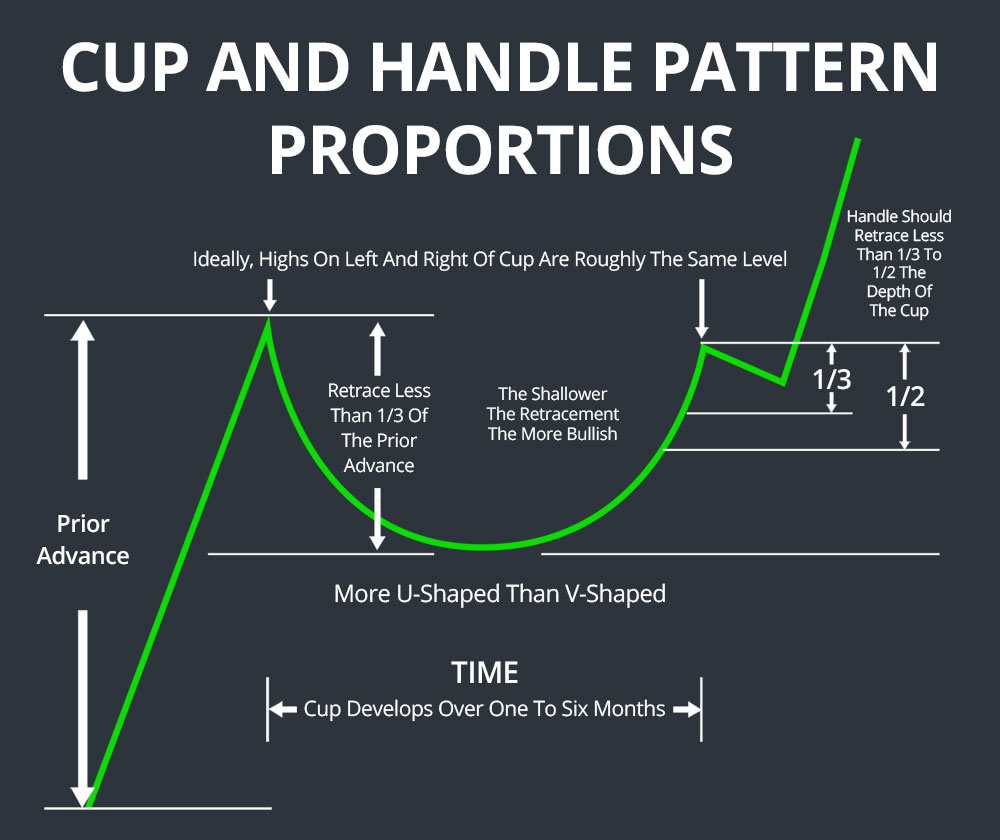

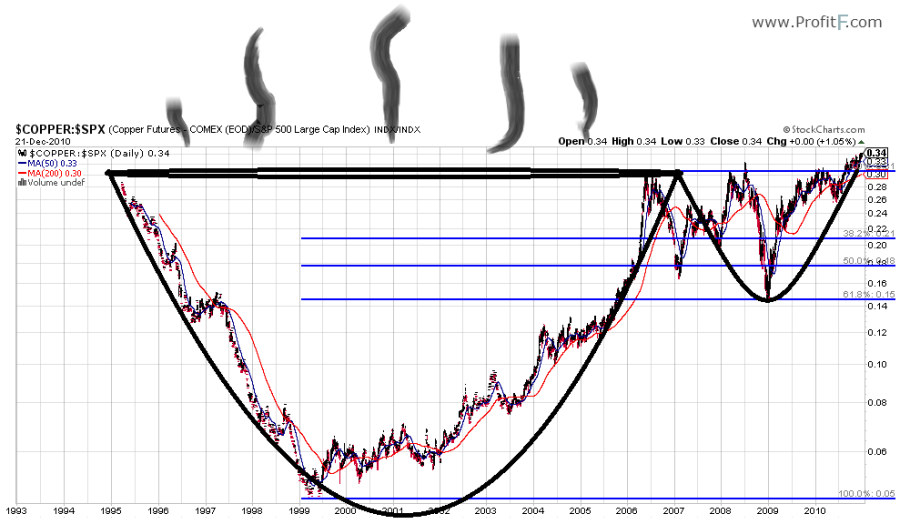

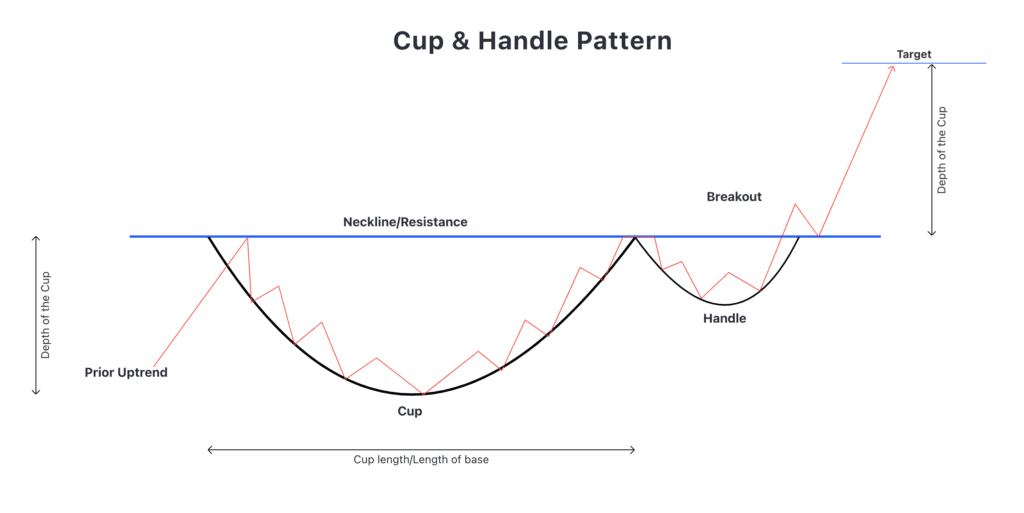

Cup With Handle Pattern Chart - But how do you recognize when a cup is forming a handle? Web the cup and handle pattern strategy is a bullish continuation pattern on a price chart that resembles a cup with a handle. Web cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The high points of the cup and the handle are aligned on the same horizontal resistance line. This pattern is known for its reliability and has been widely used by traders to identify potential trend reversals and continuation opportunities. The pattern starts with a rounded bottom (the cup) that resembles a “u” shape. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout. It's the starting point for scoring runs. Learn how to read this pattern, what it means and how to trade. Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle. Web the cup and handle pattern strategy is a bullish continuation pattern on a price chart that resembles a cup with a handle. The high points of the cup and the handle are aligned on the same horizontal resistance line. Web originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for traders forecasting bullish momentum. Web a ‘cup and handle’ is a chart pattern that can help you predict future price movements. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. A cup and handle is both a bullish continuation and a reversal chart pattern that generally appears in an uptrend. It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. Web one such chart pattern that has proven to be powerful for financial traders is the cup and handle pattern. This pattern is known for its reliability and has been widely used by traders to identify potential trend reversals and continuation opportunities. It gets its name from the tea cup shape of the pattern. But how do you recognize when a cup is forming a handle? Learn how to trade this pattern to improve your odds of making profitable trades.. The pattern starts with a rounded bottom (the cup) that resembles a “u” shape. The cup and the handle. How to identify the cup and handle pattern on a chart: Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. The high points of the cup and the handle are. Web a cup and handle is a chart pattern made by an asset’s price indicative of a future uptrend. Learn how to trade this pattern to improve your odds of making profitable trades. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. Web almost every pattern has its opposite. Learn how it works. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. Web the ‘cup and handle’ term translates to the bar chart pattern. The cup and the handle. And once you do, where is the buy point? How to identify the cup and handle pattern on a chart: Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Learn how to trade this pattern to improve your odds of making profitable trades. Web cup with. Learn how to read this pattern, what it means and how to trade. Web the cup with handle chart pattern is to serious investors what the single is to a baseball fan. See the annotated chart above as you review the 10 steps below: Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period. Web cup with handle is a price pattern that has a rounded downward turn followed by a short handle. Web one of the most famous chart patterns when trading stocks is the cup with handle. The cup and handle chart pattern does have a few limitations. Web the chart pattern, cup with handle, is a continuation pattern formed by two. Web originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for traders forecasting bullish momentum. Web it is a bullish continuation pattern that resembles a cup with a handle. Web cup with handle is a price pattern that has a rounded downward turn followed by a short handle. The. Let's consider the market mechanics of a typical cup. Web the cup and handle is one of many chart patterns that traders can use to guide their strategy. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. How to identify the cup and handle pattern on a chart:. Learn how to read this pattern, what it means and how to trade. The cup forms after an advance and looks like a bowl or rounding bottom. Web a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Web one of the most famous chart patterns when. Learn how it works with an example, how to identify a target. The cup presents as a bowl shape whilst the handle is depicted as a downward slanting period of consolidation. From ibm ( ibm) in 1926 and walmart ( wmt) in 1980 to nvidia in 2016 and again in 2020, countless big winners have made large. Web originating in the stock market and popularized by william o’neil, the cup and handle pattern serves as a powerful tool for traders forecasting bullish momentum. The cup and handle chart pattern is considered reliable based on 900+ trades, with a 95% success rate in bull markets. How to identify the cup and handle pattern on a chart: It is considered one of the key signs of bullish continuation, often used to identify buying opportunities. It marks a consolidation period followed by a breakout, often indicating a potential upward price movement. Web the cup and handle pattern strategy is a bullish continuation pattern on a price chart that resembles a cup with a handle. Web the ‘cup and handle’ term translates to the bar chart pattern. A cup and handle pattern acts as a consolidation pattern when it forms in an uptrend. Web a cup and handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout. Web cup with handle is a price pattern that has a rounded downward turn followed by a short handle. It is believed that after the breakdown of the handle, the price will go further in the direction of the trend by. The cup and the handle. Web william o'neil's cup with handle is a bullish continuation pattern that marks a consolidation period followed by a breakout.Cup And Handle Pattern Artinya

Trading the Cup and Handle Chart pattern

Cup and Handle chart pattern Best guide with 2 examples!

Cup and Handle Pattern Meaning with Example

Cup and Handle Definition

Cup and Handle Chart Pattern How To Use It in Crypto Trading Bybit Learn

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and handle chart pattern How to trade the cup and handle IG UK

Cup and Handle Patterns Comprehensive Stock Trading Guide

Cup and Handle Patterns Comprehensive Stock Trading Guide

The High Points Of The Cup And The Handle Are Aligned On The Same Horizontal Resistance Line.

Web One Such Chart Pattern That Has Proven To Be Powerful For Financial Traders Is The Cup And Handle Pattern.

Web Almost Every Pattern Has Its Opposite.

A Cup And Handle Is Both A Bullish Continuation And A Reversal Chart Pattern That Generally Appears In An Uptrend.

Related Post:

:max_bytes(150000):strip_icc()/CupandHandleDefinition1-bbe9a2fd1e6048e380da57f40410d74a.png)